By Dr. Christopher Kuehl and Mr. Keith Prather of Armada Corporate Intelligence

Published August 29, 2023

One of the hot topics in the national economy is the re-shoring of manufacturing in the United States and the impact that it is having. There are three types of alternative sourcing (shifting some volumes away from current source markets) taking place today:

- Re-shoring (the process of bringing sourcing and manufacturing back to the United States),

- Near-shoring (bringing production and sourcing to Mexico or Canada), or

- Friend-shoring (sourcing in a country that is reasonably aligned with the US geopolitically and economically).

The importance of the re-shoring trend is beginning to show up in real time data. For instance, three segments of the US economy were responsible for most of the economic growth experienced in the second quarter of this year:

- Consumer spending,

- Government expenditures, and

- Nonresidential construction.

Nonresidential construction is drawing the most interest among analysts and is part of a long-term cycle that has started to emerge in the past 18 months, and it is largely being driven by the re-shoring trend.

How did it start?

Since the early 1990’s, the US has gone through a generalized offshoring trend. Based on available technologies and data visibility at the time, companies found that the labor cost differential was significant enough that manufacturing products in low-cost labor environments around the world was the best way to maximize profits. According to the Bureau of Economic Analysis, in 1990, imports of goods accounted for 10.6% of US GDP and progressed to a peak of 17.4% in 2019 before starting a mild retreat. Over the past two years, that percentage has fallen to 14.6%. But this latest data contains a tremendous amount of “noise” due to the pandemic and supply chain challenges.

The global pandemic uncovered deficiencies and vulnerabilities in the global supply chain between 2020 and 2022. Chronic bottlenecks and shortages of products emerged at the end of the pandemic. Government mandates to create supply chain resiliency and continuity occurred. Critical segments of the US supply chain covering pharmaceuticals, defense, rare earth materials, electronics, hi-tech chips, food, and many other products are the ongoing focus of government action to secure those components of the supply chain.

For the most part, companies are not removing 100% of their sourcing from China. Many companies enjoy access to one of the largest consumer markets in the world, and maintaining operations in China to retain access to that large market is critical. Therefore, this re-shoring trend is more about supply chain diversification than true re-shoring. There are certainly some companies that are completely removing themselves from some markets, but those tend to be industry specific and are usually tied to US national security or defense sectors.

Many corporations have mandated that their executives re-shore and secure a percentage of their global sourcing in US markets or in a near-shoring strategy using Mexico or Canada. This is part of a future risk mitigation strategy to avoid exposure to unnecessary risk without having a contingency plan in place.

Automation is also now playing a larger role in sourcing strategy. Modern manufacturing processes allow for more efficiency than operations of a decade ago, using automation to make employees more productive while improving profitability in the process. In addition, rising labor costs in many areas of the world have helped close the labor price gap, and automation in US facilities further closes that gap.

Lastly, logistics and supply chain technologies have become advanced enough that executives can receive an accurate accounting of the real total landed cost of a product. What they are learning is that, in many cases, it is just as cost effective to source a product in the US. Even if the actual production costs are higher, the advantages of keeping inventories lean, coupled with cheaper and shorter transportation and logistics costs, can offset those basic production cost disadvantages and improve overall profitability. This also allows a manufacturer to become more flexible and responsive to changing market demand, improving efficiency, eliminating stockouts and delivery delays, and increasing customer satisfaction in the process.

Is there any real re-shoring activity taking place?

Corporate executives have discussed re-shoring, near-shoring, or friend-shoring for a decade or more. But beyond discussing the potential, very little real spending activity was taking place to start the process of shifting actual production to the US or alternative markets until 2021.

According to the US Census Bureau, re-shoring activity largely accounts for the more than $195 billion in annualized construction spending in 2023. This is up 79.9% year-over-year and is well above the decade average of $60 billion in annual spending.

This activity is widespread across the country. The site selection process takes place across a broad area of the country and is generally located where distribution systems are efficient and free from unexpected and frequent disruptions. There is also an affinity for areas with a lower cost of living, good access to affordable and stable energy resources, decent labor availability, and lower regulatory concerns.

Many companies favor locations with good access to local universities for skilled labor (engineers, finance, high-tech, HR, managers, etc.).

There are a few corridors in the US that are getting more attention than others. The midsection of the country is attracting a lot of attention. Areas up and down the I-35 corridor that connects Canada, the US, and Mexico are seeing development. There are also many firms choosing markets in the Tennessee and Ohio Valley corridors. These areas are largely benefactors of population migration over the past three years, and labor availability can sometimes be better than in other areas.

Another consideration for many companies is the proximity to core suppliers or complementary industries. For instance, battery manufacturers for electric vehicles often select areas near automotive Original Equipment Manufacturers (OEM) where the batteries will be loaded into vehicles. Subsequently, many suppliers that feed battery manufacturers are located near those assembly lines. This creates a concentration of manufacturing tied to large OEMs. Other industries are making similar choices and are aggregating suppliers and OEMs to create a unique manufacturing ecosystem, something that isn’t new. Again, keeping inventories lean and reducing transit times are important in driving profitability, and appropriate location selection is critical.

How Important is this Trend in Economic Terms?

Economic multipliers help us understand what one dollar of spending in an industry creates in general economic activity. For manufacturing, one dollar of spending in the manufacturing sector generates $3 dollars of additional economic activity (1:3). Construction of nonresidential structures also carries a 1:3 economic multiplier. Comparing that to spending such as government investments in social services, the multiplier is typically 1:1.5 ($1 of spending generating $1.50).

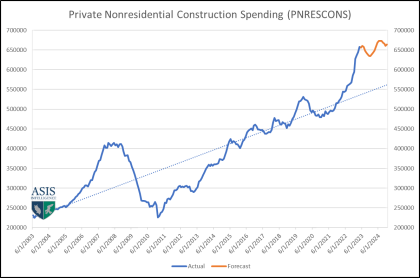

Armada models that forecast nonresidential construction spending show it continuing to outpace historic volume trends by 22% over the next 18 months. Manufacturing related construction activity is still the largest sector of nonresidential spending and is largely driving this positive outlook. Construction spending in the manufacturing category is currently exceeding $195 billion annually, up from the ten year average prior to the pandemic of $60 billion.

This statistical model has shown 96% accuracy forecasting six months in advance and incorporates 18-22 economic metrics statistically trained over 20 years.

The bottom line is that the manufacturing sector is a significant economic engine for the US, and as we experienced in Q2, was one of three legs of a stool that drove macroeconomic GDP growth to 2.4% (which came in well above expectations). Changes in the political party controlling the White House and Congress have shown no significant changes in their approach to limiting trade and sourcing products in countries that have taken an adversarial position against the US. In other words, the likelihood of a reversal in policy is low. In addition, other factors such as supply chain visibility provided by advanced technologies and automation, financial incentives, reduced bottlenecks, and supply chain disruptions have led to this diversification of supply chain sourcing. And whether re-shoring, near-shoring, or friend-shoring, the trend is gaining momentum.

If current forecasts continue to hold, it will continue to be a significant driver of broad economic activity well into 2024 and beyond. And it will continue to be a significant contributor to US GDP growth and create opportunities for firms that support the manufacturing sector.

About the Authors

Dr. Christopher Kuehl and Keith Prather are founders and managing directors of Armada Corporate Intelligence. Dr. Kuehl holds a Ph.D in Political Economics and Master’s Degrees in Soviet Studies and East Asian Studies. He works with a wide variety of corporate clients around the world and is the economist for several national and international organizations. Mr. Prather has been providing corporations with market intelligence and analysis covering domestic and global economics, geopolitics, raw material and supply chain developments, environmental impacts and other factors that affect the corporate operating environment for more than 22 years.

Disclosure and Important Considerations

This communication is provided for informational purposes only. The opinions expressed herein are those of the author and do not necessarily represent the opinions of CrossFirst Bankshares Inc. or CrossFirst Bank. This communication references certain data and statistical information, which has been obtained from various independent, third party sources and publications. The information is believed to be reliable as of the date of this communication, but we have not independently verified the information and do not warrant its completeness or accuracy. CrossFirst Bankshares Inc. and CrossFirst Bank are not liable for any errors, omissions, or misstatements. You should not use this information as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning, or investment decisions. This communication contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. This is not an offer or solicitation for the purchase or sale of any financial instrument.

August 29, 2023 by CrossFirst Bank