By Dr. Christopher Kuehl and Mr. Keith Prather of Armada Corporate Intelligence

Early May marked the 10th consecutive increase in the Federal Funds Rate by the Federal Reserve (Fed). The setting of the rate determines much of the pace of economic growth. Central banks like the Federal Reserve have a dual mandate that is becoming increasingly more difficult to satisfy. They are charged with both promoting economic expansion and job growth while controlling inflation. One mandate is accomplished through lowering interest rates and the other is accomplished through increasing them. If the institution had a single duty and obligation, it would be simple to determine the policy preference.

In the aftermath of the 2008 financial crisis the focus was on stimulating the economy so that businesses could recover and improve job availability. The Fed’s Open Market Committee voted eleven to one to drop rates to near zero. They remained at those levels for several years as the economy needed the boost. Then came the pandemic-induced recession of 2020 and the further need to stimulate the economy. Interest rates stayed near zero and the fiscal side of government jumped in with nearly a trillion dollars of stimulus aid for businesses and individuals. It can be argued that this massive effort had the desired impact considering the economy snapped back with real GDP growth of 5.9% in 2021.

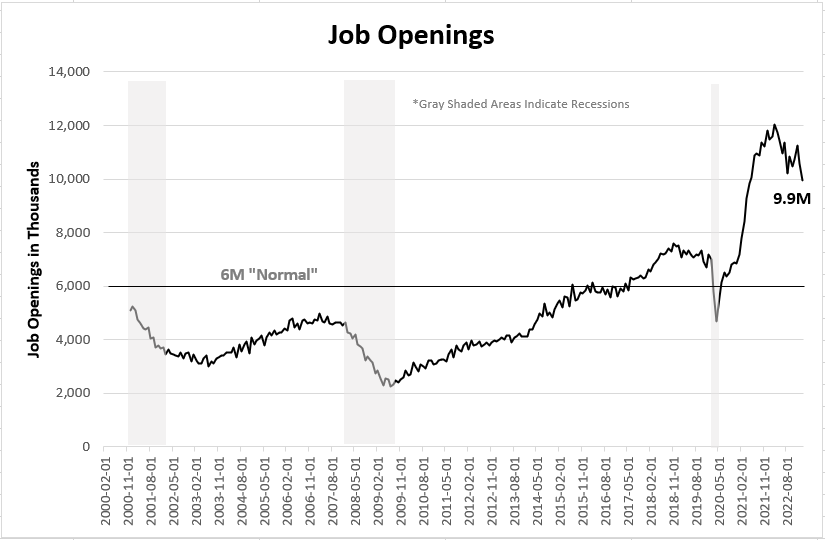

That flood of cash has had a lingering impact. The combination of a trillion dollars of aid, a global supply chain breakdown, and a sharp reduction in workforce availability pushed inflation to levels not seen in over four decades. Job openings surged to a record high of 12 million in March of 2022 (6 million is an average reading for job openings). The mandate for the Fed changed and inflation became a concern. At first the desire to help the economy rebound from th e 2020 pandemic lockdown dominated policy, but soon inflation was spiking at a rate that could not be ignored. The Russian invasion of Ukraine accelerated the inflation problem, and ongoing sanctions triggered a global surge in the price for energy. Inflation rates soared to double digits in Europe and the consumer price index (CPI) hit 8.9% in June of 2022 in the US.

e 2020 pandemic lockdown dominated policy, but soon inflation was spiking at a rate that could not be ignored. The Russian invasion of Ukraine accelerated the inflation problem, and ongoing sanctions triggered a global surge in the price for energy. Inflation rates soared to double digits in Europe and the consumer price index (CPI) hit 8.9% in June of 2022 in the US.

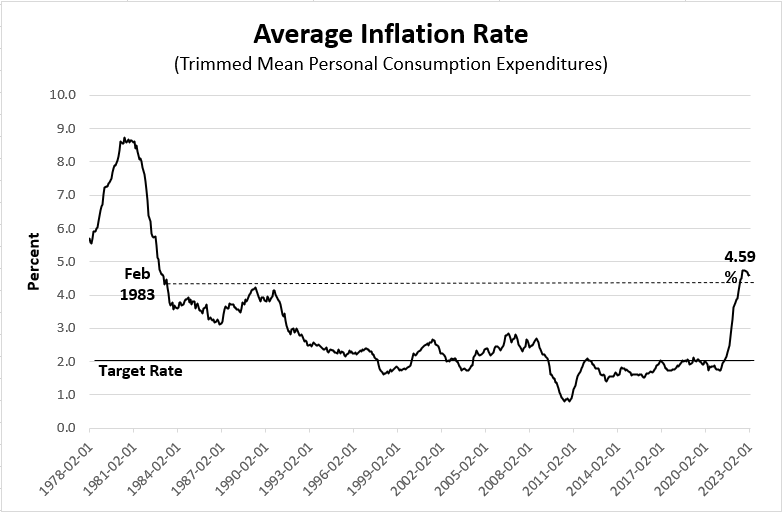

This situation has left the Fed with its current dilemma. Inflation is still nearly double the rate preferred. The preferred measure of inflation is the TMPCE (Tri mmed Mean Personal Consumption Expenditure). It is generally more accurate than the more commonly cited CPI but the data lags by two months. We are just now getting a sense of the February rate of inflation, and it seems that inflation has peaked, as many predicted, at the end of last year. The last reading had the TMPCE at an annual rate of 4.59%, the lowest since July of 2022 but only moderately lower than September of last year when it hit its highest rate since November of 1982 at 4.75%. This is a slight improvement but still far from the range between 2.0% and 2.5% the Fed would prefer.

mmed Mean Personal Consumption Expenditure). It is generally more accurate than the more commonly cited CPI but the data lags by two months. We are just now getting a sense of the February rate of inflation, and it seems that inflation has peaked, as many predicted, at the end of last year. The last reading had the TMPCE at an annual rate of 4.59%, the lowest since July of 2022 but only moderately lower than September of last year when it hit its highest rate since November of 1982 at 4.75%. This is a slight improvement but still far from the range between 2.0% and 2.5% the Fed would prefer.

Looking at this data alone would indicate that rates will continue to rise. The mantra of the central bank is generally that rates are hiked until something breaks, and then rates are subsequently lowered to fix what was broken. In most years, the measure of whether there has been enough breakage has been the rate of unemployment. Once there has been an impact on the job market with extensive layoffs, the sense is that the economy has slowed enough.

Unfortunately, the job data has been far less reliable than in past years. Two factors have contributed to the weakening of unemployment data as a proxy for overall economic slowdown. The primary issue is the chronic worker shortage. Employers have been struggling to find appropriate workers for years and they are losing the experienced members of their workforce at an accelerating rate. By 2030, the entire Boomer generation will have reached retirement age, estimated to be 73 million people, according to the Census Bureau.

The second factor has been the rise of the “gig economy.” Millions of people are now quasi-employed in jobs such as ride sharing, food deliveries, and a host of others. We are not sure how to count people in these positions, as they often assert they are not actually employed. In the absence of reliable employment data, the Fed watches a wide variety of datapoints from retail sales, capacity utilization, industrial production, PMI indices and so on. Unfortunately, they often tell contradictory stories.

In the last few months, there has been another consideration for the central banks and for the entire bank regulatory system. Higher interest rates affect the bond market. The shift is described as duration risk. It is a measure of a bond’s interest rate that considers a bond’s maturity, coupon, yield, and call features. It measures the impact on bonds when interest rates rise. The recent fallout from the few banks and investors that didn't take the risk into consideration was evident. As the dust has settled it has become clear that a few of those institutions had been troubled for some time. These issues were not widespread, and the banking system remains healthy. The problem is that investors and depositors reacted immediately in those isolated cases.

Hiking rates further will put additional pressure on the bond market and that will negatively affect banks that have large bond holdings, as well as the overall bond market. It also slows the economy (as designed).

The investment community seems convinced the Fed will stop hiking rates and will start lowering them by the summer. There is some precedence to consider with this projection. Over the last forty to fifty years the central banks have generally started to lower rates eight to nine months after there has been a peak in inflation. If there was a peak in global inflation in December of 2022, the eight-month mark will be in July or August. Thus far the Fed has not indicated a desire to reduce rates, and the inflation numbers are still far higher than they want. Alternatively, there is obvious impact from the higher rates – slower pace of new home construction, slower retail, consumers accessing credit for necessities, and more. The assertion at the moment is that there is a 50-50 chance for reduced rates by mid-summer.

About the Authors

Dr. Christopher Kuehl and Keith Prather are founders and managing directors of Armada Corporate Intelligence. Dr. Kuehl holds a Ph.D in Political Economics and Masters Degrees in Soviet Studies and East Asian Studies. He works with a wide variety of corporate clients around the world and is the economist for several national and international organizations. Mr. Keith Prather has been providing corporations with market intelligence and analysis covering domestic and global economics, geopolitics, raw material and supply chain developments, environmental impacts and other factors that affect the corporate operating environment for more than 22 years.

Disclosure and Important Considerations

This communication is provided for informational purposes only. The opinions expressed herein are those of the author and do not necessarily represent the opinions of CrossFirst Bankshares Inc. or CrossFirst Bank. The information is believed to be reliable, but we do not warrant its completeness or accuracy. CrossFirst Bankshares Inc. and CrossFirst Bank are not liable for any errors, omissions, or misstatements. You should not use this information as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning, or investment decisions. This communication contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. This is not an offer or solicitation for the purchase or sale of any financial instrument.